In an era where digital transactions are increasingly becoming the norm, TnG Digital has announced a bold move to mandate electronic Know Your Customer (eKYC) verification for all TnG eWallet users by the end of 2024.

This initiative is set to catapult the company to the forefront of digital security, making it the first eWallet service in Malaysia to achieve 100% eKYC compliance among its users.

As of today, an impressive 77% of TnG eWallet’s user base has already embraced the eKYC verification process, showcasing a proactive commitment to securing their digital transactions against fraud.

The eKYC system, a digital verification method that utilizes advanced security features including facial recognition, is designed not only to bolster user security but also to streamline financial transactions, making them more efficient and user-friendly.

In addition to enhancing security measures, TnG eWallet is set to roll out a plethora of new features throughout 2024. Among these are a revolutionary revolving credit line for seamless payments, updates to its lending features through GOpinjam with more attractive terms, and the introduction of investment opportunities in gold and stocks. These innovations are geared towards providing users with a comprehensive financial management tool, directly from their digital wallet.

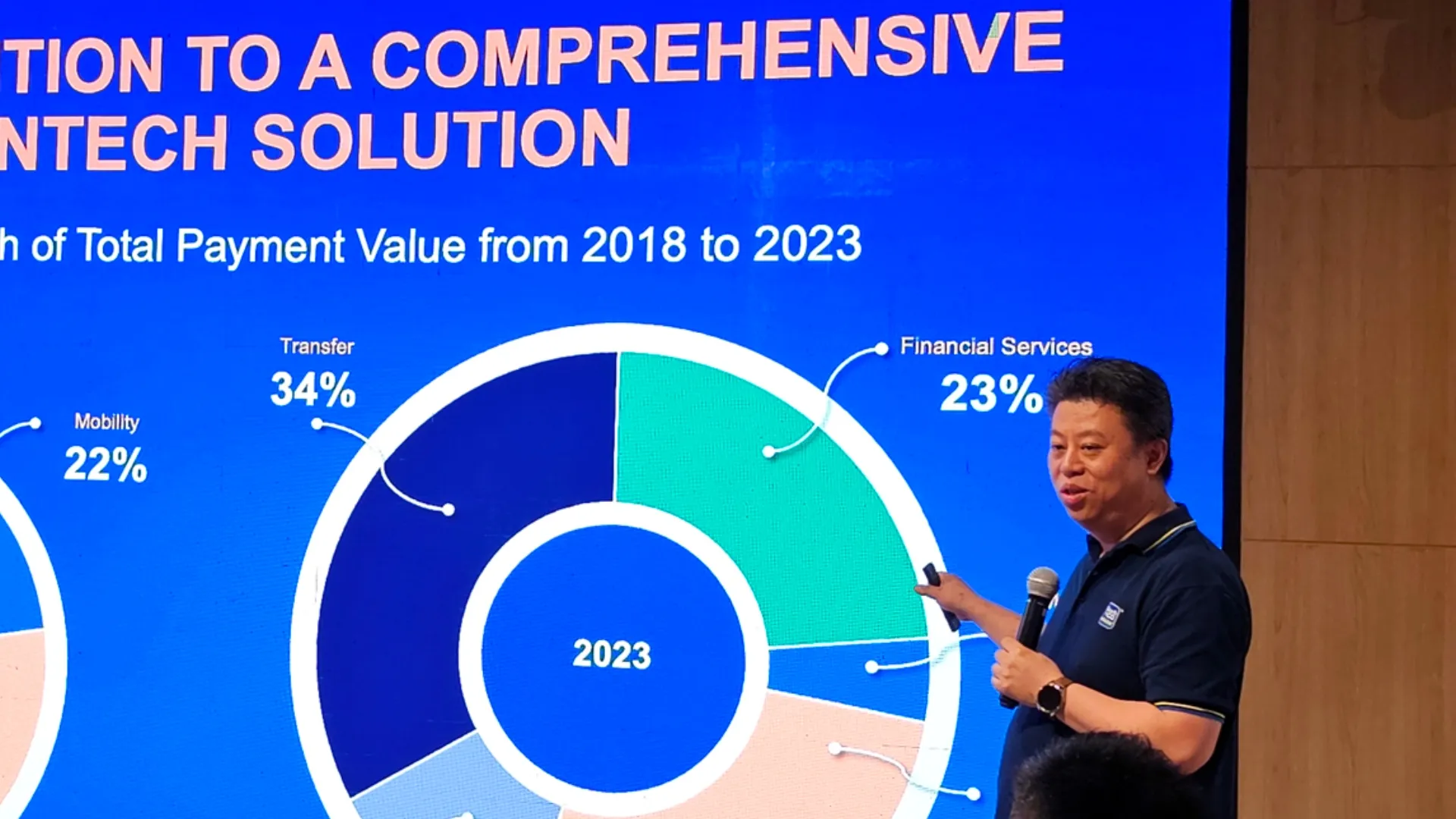

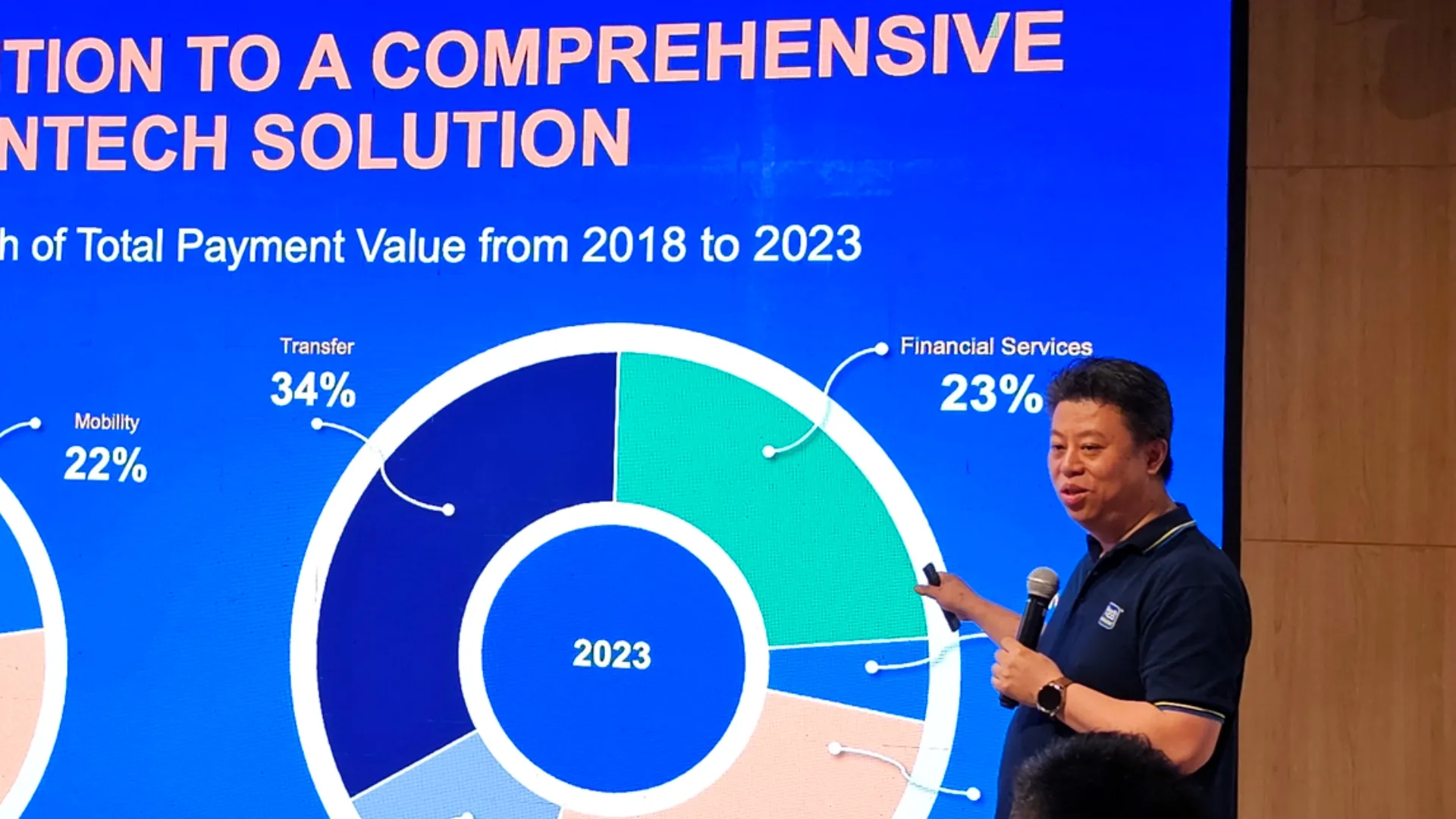

However, what sets TnG Digital apart is not just its commitment to security and innovation but also its market dominance. With a 50% market share in Malaysia and a Total Payment Value (TPV) exceeding RM 7 billion a month, TnG eWallet has solidified its position as a leader in the fintech space.

This is further evidenced by its vast user base, which encompasses two-thirds of the Malaysian population, totaling 20.9 million verified eKYC users.

For merchants, TnG Digital’s expansion plans are equally ambitious. The introduction of a new merchant wallet, enhanced financial services products, and features designed to increase in-store experiences and foot traffic underline TnG’s commitment to being a one-stop solution provider for businesses, especially SMEs.

As TnG Digital gears up for these comprehensive updates and security enhancements, the eWallet landscape in Malaysia is poised for a significant transformation.

With mandatory eKYC verification, TnG eWallet users can look forward to not only a safer digital transaction environment but also a richer, more diverse financial ecosystem at their fingertips.

By setting a new industry standard for digital security and financial services, TnG eWallet is not just preparing for the future; it is defining it.

As we move closer to the 2024 milestone, the anticipation among users and merchants alike is palpable, marking the beginning of a new era in digital finance.